Flood mitigation discounts for insurance are gaining attention as homeowners seek ways to manage their insurance costs effectively. These discounts not only help lower premiums but also encourage property owners to adopt practices that reduce flood risk. By understanding the criteria that insurers use to offer these discounts, homeowners can make informed decisions about flood mitigation measures that may qualify them for savings.

As we delve deeper into the topic, we’ll explore what flood mitigation discounts entail, the relationship between flood insurance and other insurance types, and various strategies homeowners can employ to maximize their benefits. Whether you’re a new homeowner or looking to reassess your current insurance plan, grasping the essence of these discounts is vital for financial planning and property protection.

Understanding Flood Mitigation Discounts for Insurance

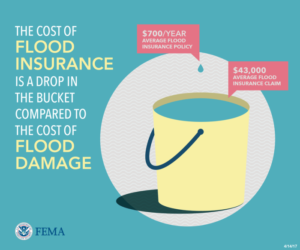

Flood mitigation discounts serve as an incentive for homeowners to invest in measures that minimize flood damage risk. By implementing certain flood-resistant features or strategies, homeowners may qualify for reduced insurance premiums. This not only makes insurance more affordable but also supports the broader goal of reducing flood-related losses in communities.Insurance companies utilize a variety of criteria to determine eligibility for flood mitigation discounts.

These criteria typically assess the effectiveness of the flood mitigation measures in reducing risk. Factors such as the location of the property, the historical flood data for the area, and the specific improvements made can influence the discount offered.

Criteria for Eligibility

Insurance companies have a defined set of standards and criteria that homeowners must meet to be eligible for flood mitigation discounts. These criteria are essential for assessing the potential risk reduction and overall effectiveness of the mitigation measures. Some common factors include:

- Elevation of the Property: Homes that are elevated above the base flood elevation are often eligible for discounts.

- Use of Flood-Resistant Materials: Utilizing materials that can withstand flood conditions, such as concrete or water-resistant insulation, can qualify a homeowner for a discount.

- Installation of Flood Vents: These allow floodwaters to flow through the foundation, helping to prevent structural damage and can lead to lower insurance premiums.

- Landscaping Techniques: Proper grading and landscaping that directs water away from the home can be beneficial in reducing flood risk and may qualify for discounts.

- Retention Basins or Rain Gardens: These features are designed to manage stormwater runoff and can significantly reduce flooding potential.

Common Flood Mitigation Measures

Homeowners can implement various flood mitigation strategies that not only protect their property but also foster eligibility for insurance discounts. These measures address potential vulnerabilities and help reduce overall flood risk. Some common examples include:

- Installing Sump Pumps: Sump pumps can effectively remove water from basements, reducing the risk of flooding and water damage.

- Sealing Foundation Cracks: Addressing any cracks in the foundation helps to prevent water intrusion during heavy rainfall or flooding events.

- Building Barriers: Flood walls or levees can provide a physical barrier against rising water, which may lead to discounted rates.

- Regular Maintenance of Drainage Systems: Keeping gutters and drains clear can help manage excess water effectively and prevent flooding.

“Implementing effective flood mitigation measures not only protects your home but can lead to significant savings on insurance premiums.”

Relationship Between Flood Insurance and Other Insurance Types

Flood insurance serves a unique purpose in the realm of risk management, distinct from other insurance types such as health and dental insurance. Understanding these relationships is essential for consumers looking to protect their financial interests comprehensively. This discussion delves into how flood insurance compares and contrasts with health insurance, the potential effects of flood mitigation discounts on dental insurance pricing, and the importance of integrating flood insurance with disability insurance for a well-rounded protection plan.

Comparison of Flood Insurance and Health Insurance Regarding Risk Assessment and Coverage

Flood insurance and health insurance are both pivotal in safeguarding against unforeseen circumstances, but they operate under different risk assessment models. Flood insurance is primarily concerned with property and physical damage, often influenced by geographical and environmental factors. Risk assessment in flood insurance heavily relies on flood zone maps, historical data, and mitigation efforts taken by property owners. In contrast, health insurance focuses on individual health risks, which are assessed through medical history, age, lifestyle choices, and pre-existing conditions.

Health insurance coverage typically encompasses hospital stays, outpatient services, preventive care, and prescription medications, while flood insurance provides coverage for damage to buildings and personal property caused specifically by flooding events.

“Flood insurance is based on geographic risk factors, while health insurance assesses individual health risks.”

Impact of Flood Mitigation Discounts on Dental Insurance Pricing

Flood mitigation discounts have a unique ripple effect on various types of insurance, including dental insurance. When property owners engage in effective flood mitigation measures, such as elevating structures or implementing drainage systems, they reduce their overall risk exposure. Insurers often reward these proactive steps with discounts on flood insurance premiums, which can also indirectly influence dental insurance pricing.The rationale is that reduced risk from flooding can enhance the overall financial stability of a policyholder, allowing them to allocate funds more efficiently across various insurance types.

For example, a person saving on flood insurance may find it feasible to invest in higher-quality dental coverage, which can lead to a more comprehensive health strategy.

“Proactive flood mitigation can lead to better risk management across all insurance types, including dental.”

Importance of Integrating Flood Insurance with Disability Insurance for Comprehensive Coverage

Integrating flood insurance with disability insurance provides a more holistic approach to financial protection. Flood events can lead to significant property damage and disruption, potentially affecting one’s ability to work. In the aftermath of a flood, individuals may face not only the financial burden of repairing their homes but also the loss of income due to disabilities caused by such disasters.Disability insurance offers income replacement during the inability to work, and when paired with flood insurance, it ensures that individuals are safeguarded against both property loss and income disruption.

For instance, if a flood severely damages a business, the owner could be unable to work, yet still reliant on income to cover living expenses. Having both flood and disability insurance can provide peace of mind, knowing that one has financial support in multiple facets of life.

“Combining flood and disability insurance creates a robust safety net in times of disaster.”

Strategies for Maximizing Flood Mitigation Discounts

Homeowners seeking to reduce their flood insurance costs can benefit significantly from implementing various flood mitigation strategies. By taking proactive steps to safeguard their properties against flooding, homeowners can qualify for discounts on their insurance premiums. Understanding the available strategies is essential to maximize these potential savings.To effectively secure flood mitigation discounts, it is important to not only implement strategies but also to properly document and communicate these efforts to insurance providers.

This ensures that the reduction in risk is acknowledged and reflected in the insurance policy.

Checklist for Flood Mitigation Strategies

Homeowners can follow this checklist to implement effective flood mitigation strategies that may qualify them for insurance discounts:

- Evaluate the property’s flood risk through a professional assessment.

- Install flood barriers or levees to protect against rising water.

- Ensure proper drainage systems are in place, including gutters and downspouts.

- Elevate electrical systems and appliances to higher levels.

- Seal basement walls and floors to prevent water seepage.

- Landscape the yard to direct water away from the foundation.

- Consider flood-resistant materials for renovations and repairs.

- Enroll in a community floodplain management program.

Documenting and Submitting Flood Mitigation Efforts

Documenting flood mitigation efforts is a critical step in securing discounts with insurance providers. Homeowners should keep thorough records of all improvements made, including:

- Receipts and invoices from contractors who performed the work.

- Before-and-after photographs to illustrate the changes made.

- Reports from flood risk assessments and mitigation evaluations.

- Descriptions of any DIY improvements, detailing materials used and processes followed.

Once the documentation is prepared, homeowners should contact their insurance provider to inquire about the specific requirements for submitting mitigation efforts. This often involves filling out forms detailing the improvements alongside the collected documentation.

Discount Percentages Based on Mitigation Measures

The discounts homeowners can receive for implementing specific flood mitigation measures can vary widely. Below is a table illustrating potential discount percentages based on common mitigation strategies:

| Mitigation Measure | Potential Discount Percentage |

|---|---|

| Installing flood barriers | 5% – 10% |

| Elevating the home above flood level | 10% – 20% |

| Improving drainage systems | 5% – 15% |

| Using flood-resistant materials | 5% – 25% |

| Enrolling in community programs | 3% – 10% |

Homeowners can save substantially on their flood insurance premiums by effectively documenting and communicating their flood mitigation efforts, potentially achieving discounts ranging from 5% to 25%.

Final Summary

In summary, flood mitigation discounts for insurance not only serve as a financial incentive for homeowners but also play a crucial role in strengthening community resilience against flooding. By understanding how to qualify for these discounts and implementing effective flood mitigation strategies, homeowners can enjoy lower insurance premiums while contributing to wider safety efforts. Ultimately, staying informed and proactive can lead to significant savings and peace of mind in the face of potential flooding risks.

Top FAQs

What are flood mitigation discounts?

Flood mitigation discounts are reductions in insurance premiums offered to homeowners who implement measures that reduce the risk of flood damage.

How can I qualify for these discounts?

To qualify, homeowners typically need to implement specific flood mitigation measures, such as elevating structures, installing flood vents, or using flood-resistant materials.

Do all insurance companies offer these discounts?

No, not all insurance companies provide flood mitigation discounts. It’s essential to check with your specific provider for availability and criteria.

How do I document my flood mitigation efforts?

Documentation can include photographs, receipts, and professional assessments detailing the improvements made to reduce flood risk.

Can flood mitigation discounts affect other types of insurance?

Yes, incorporating flood mitigation strategies can potentially impact the pricing and coverage of other insurance policies, such as homeowners and even liability insurance.